Maintenance Margin is essential for sustaining a position in trading. This article will delve into the calculation process specifically for USDT Perpetual contracts.

What is the Maintenance Margin?

Maintenance Margin is the minimum amount of margin a trader must maintain in their position or account to continue holding a position. When unrealized losses cause the position margin in a position or account to fall below the required maintenance margin level, liquidation will be triggered.

As traders hold larger contract values (position value + order value), the maintenance margin required will also increase by a fixed percentage as the contract value rises to a specific level. Each trading pair has its maintenance margin base rate, which adjusts according to changes in the risk limit tiers.

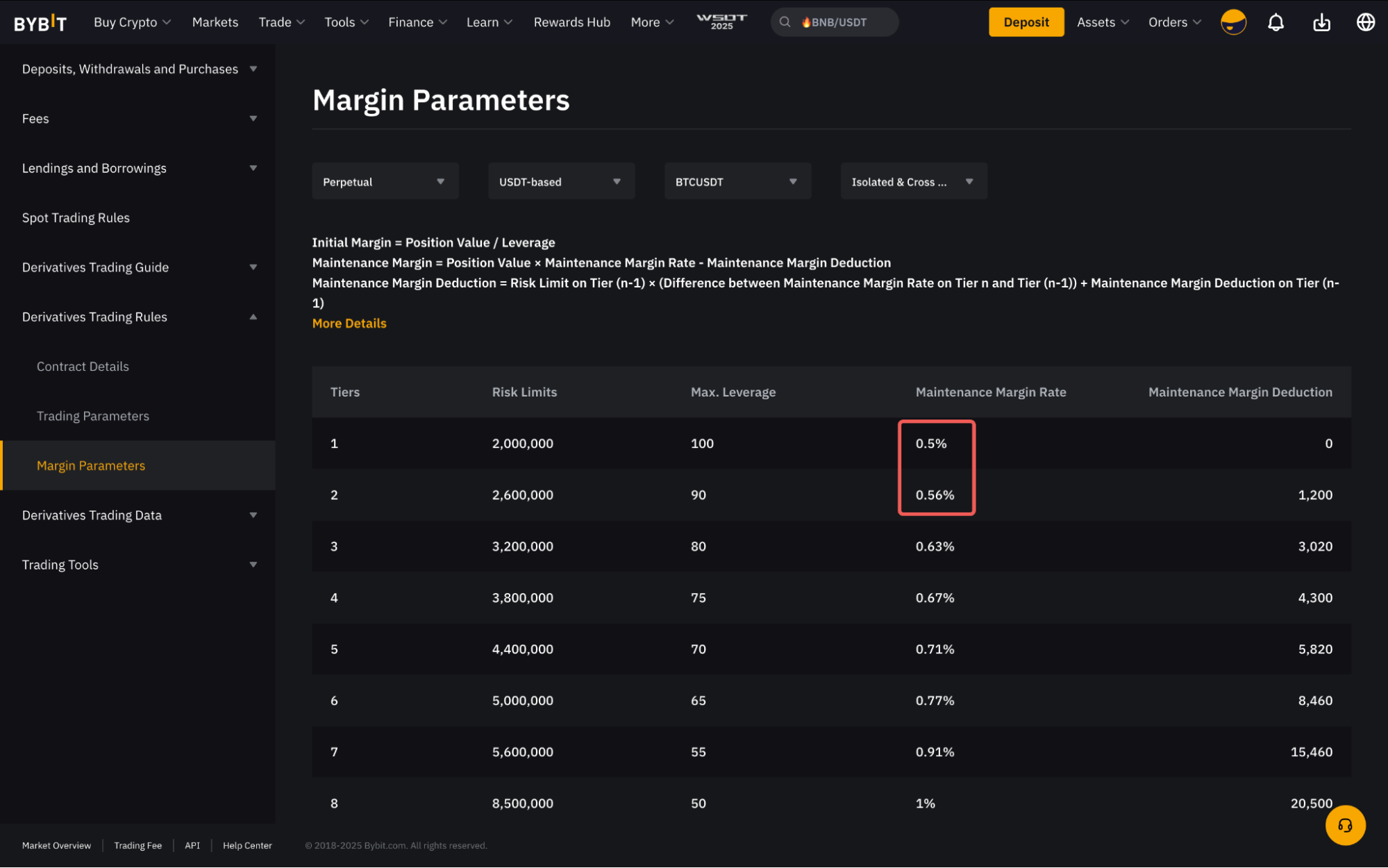

For example, when you open a BTCUSDT position with a position value of 2,000,000 USDT or below, the maintenance margin rate (MMR) required for the position is 0.5% of the position value. If the position value increases to 2,600,000 USDT, the MMR required will also increase to 0.56% of the position value.

For more details regarding risk limits, please refer to our guide here.

Calculation of Maintenance Margin Rate (MMR)

The Maintenance Margin Rate (MMR) for each position is determined using a tier-based calculation according to the margin level of the position value. Any excess beyond a particular tier is subject to the calculation based on the MMR of the new tier.

Illustration

The table below shows the margin parameters of XYZUSDT contracts.

|

Tier |

Risk Limit (USDT) |

Maintenance Margin Rate Required |

|

1 |

0 - 1,000 |

2% |

|

2 |

>1,000 - 2,000 |

2.5% |

|

3 |

>2,000 - 3,000 |

3% |

|

4 |

>3,000 - 4,000 |

3.5% |

|

5 |

>4,000 - 5,000 |

4% |

Assuming the mark price remains unchanged at 35 USDT, a trader enters a long position of 100 contracts with 10x leverage at 35 USDT; the contract’s position value would be 3,500 USDT.

Position Value = Contract quantity x Mark Price

= 100 x 35 = 3,500 USDT.

Initial Margin = Position Value / Leverage

= 35 x 100 / 10 = 350 USDT

Maintenance Margin = Position Value x MMR

= (1,000 x 2%) + (1,000 x 2.5%) + (1,000 x 3%) + (500 x 3.5%)

= 92.5 USDT

This means that the position can withstand a maximum unrealized loss (calculated using Mark Price) of 257.5 USDT (350 USDT - 92.5 USDT) before liquidation takes place.

Formula

Now that you understand how the maintenance margin is calculated, as seen in the illustration above, the calculation can be quite tedious when dealing with large position values. Therefore, for the sake of simplicity, we can use the following formula to calculate the position maintenance margin.

Position Value = Contract Size x Mark Price

Maintenance Margin (MM) = (Position Value x MMR) - Maintenance Margin Deduction

whereas,

MM Deduction on Tier n = Risk Limit on Tier n-1 x (Difference between MMR on Tier n and Tier n-1) + MM Deduction on Tier n-1

Since the position value is calculated as contract size × mark price, and the mark price keeps changing, the position value will also change accordingly. As a result, your risk limit tier adjusts in real time, which in turn affects the required maintenance margin (MMR). For example, if the mark price increases and causes your position value to rise, your risk limit tier may move from Tier 2 to Tier 3, resulting in a higher MMR requirement and increased account risk.

The MMR required for each risk limit tier and the Maintenance Margin Deduction amount can be easily found on the Margin Parameters page.

Examples

The table below shows the Margin Parameters for ETHUSDT.

|

Tier |

Risk Limits |

Max. Leverage |

Maintenance Margin Rate |

Maintenance Margin Deduction |

|

1 |

0 - 100,000 |

25 |

2% |

0 |

|

2 |

>100,000 - 200,000 |

20 |

2.5% |

100,000 x (0.5%) + 0 = 500 |

|

3 |

>200,000 - 300,000 |

16.67 |

3% |

200,000 x (0.5%) + 500 = 1,500 |

|

4 |

>300,000 - 400,000 |

14.29 |

3.5% |

300,000 x (0.5%) + 1,500 = 3,000 |

|

5 |

>400,000 - 500,000 |

12.5 |

4% |

400,000 x (0.5%) + 3,000 = 5,000 |

*The above table is merely an illustration and does not represent actual margin parameters. Please always refer to this page for the most updated margin parameters.

Example 1

Trader A uses 10x leverage and opens a long position of 100 ETH at a price of 4,000 USDT. Assuming Mark Price is 4,000 USDT.

Position Value = 100 x 4,000 = 400,000 USDT (Tier 4)

Initial Margin = 400,000 / 10 = 40,000 USDT

Maintenance Margin = 400,000 x 3.5% - 3,000 = 11,000 USDT

This means the position can withstand a maximum unrealized loss of 29,000 USDT (40,000 USDT - 11,000 USDT) before liquidation is triggered.

Example 2

Trader B utilizes 10x leverage and opens the ETHUSDT long position of 50 ETH at 4,000 USDT, while simultaneously having a buy limit order for 50 ETH at USDT 3,000. Assuming Mark Price for ETH is 4,000 USDT.

Position Value = Contract Quantity x Mark price

= 50 ETH x 4,000 = 200,000 USDT (Tier 2)

Position Maintenance Margin = 200,000 x 2.5% - 500 = 4,500 USDT

Order Value = Contract Quantity x Order Price

Order Maintenance Margin = 50 ETH x 3,000 x 3.5% = 5,250 USDT

Total Maintenance Margin Required = 4,500 + 5,250 = 9,750 USDT.

As a result, we can see that when an order is not filled, the order maintenance margin is calculated based on the corresponding MMR of the tier determined by the (position value + order value) instead of the tier-based calculation. The MMR required for the tier of 200,000 USDT position value + 150,000 USDT order value is 3.5%.

Assuming the buy order is now filled and the position opened, the Mark Price for ETH has now become 3,000 USDT. The total maintenance margin required has now become:

Position Value = [(50 x 3,000) + (50 x 3,000)] = 300,000 USDT (Tier 4)

Initial Margin = 300,000 / 10 = 30,000 USDT

Maintenance Margin = 300,000 x 3.5% - 3,000 = 7,500 USDT

After the order is filled, the overall maintenance margin required is reduced to 7,500 USDT. This means the position can withstand a maximum unrealized loss of 27,500 USDT (35,000 USDT - 7,500 USDT) before the liquidation is triggered.

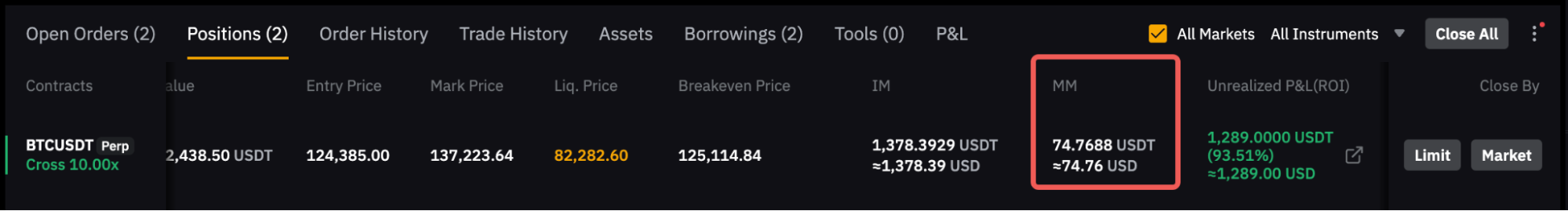

Maintenance Margin Display on Position Tab

The maintenance margin (MM) required by the position can be found in the position tab.

You may notice that the MM displayed on the position tab will be higher due to the reason that it includes the estimated fee to close the position.

The estimated fee to close for long and short positions is calculated slightly differently as follows:

Estimated Fee to Close (Long Position) = Position Size × Entry Price × (1 − 1 / Leverage ) × Taker Fee Rate

Estimated Fee to Close (Short Position) = Position Size × Entry Price × (1 + 1 / Leverage) × Taker Fee Rate

Example

Revisiting Example 1, Trader A holds a short position of 100 ETH contract at a price of USDT 4,000 with 10x leverage. Assuming the Mark Price is 4,000 USDT.

Maintenance Margin (MM) = 11,000 USDT

Estimated Fee to Close Position = 100 × 4,000 × (1 + 1/10) × 0.055% = 242 USDT

In this case, the total maintenance margin displayed on the position tab will be 11,242 USDT (11,000 USDT + 242 USDT).

Conclusion

Understanding the calculation process for both position and order maintenance margins is essential for traders to manage their risk effectively on Bybit. By comprehending how these margins are calculated, traders can make informed decisions to reduce liquidation risk and optimize their trading strategies.