Knowing how to do your taxes is an important part of being a Bybit user. While you can export your account data easily from your account, Bybit doesn’t automatically produce ready-to-file tax reports for you. As such, it is up to you to report your gains, losses, and income whenever necessary.

To make your life easier, Bybit has been integrated into the Crypto Tax Calculator so you don’t have to worry about manual calculations. Simply connect your account and your transactions will be automatically imported for you, along with a range of tax reports ready for you to submit. Let’s jump in to how to do your Bybit taxes with Crypto Tax Calculator.

Key Takeaways

-

Your Bybit crypto transactions can be tracked by tax authorities, so it’s important to report them on your tax return. Depending on your activities, you will pay either income or capital gains taxes.

-

Bybit does not currently provide tax reports, so you will need to gather the data and calculate taxes yourself.

-

The easiest way to calculate your Bybit taxes is to use a crypto tax software program like Crypto Tax Calculator, which automatically connects with your Bybit account to provide in-depth tax reports.

How to Calculate Bybit Taxes with Crypto Tax Calculator

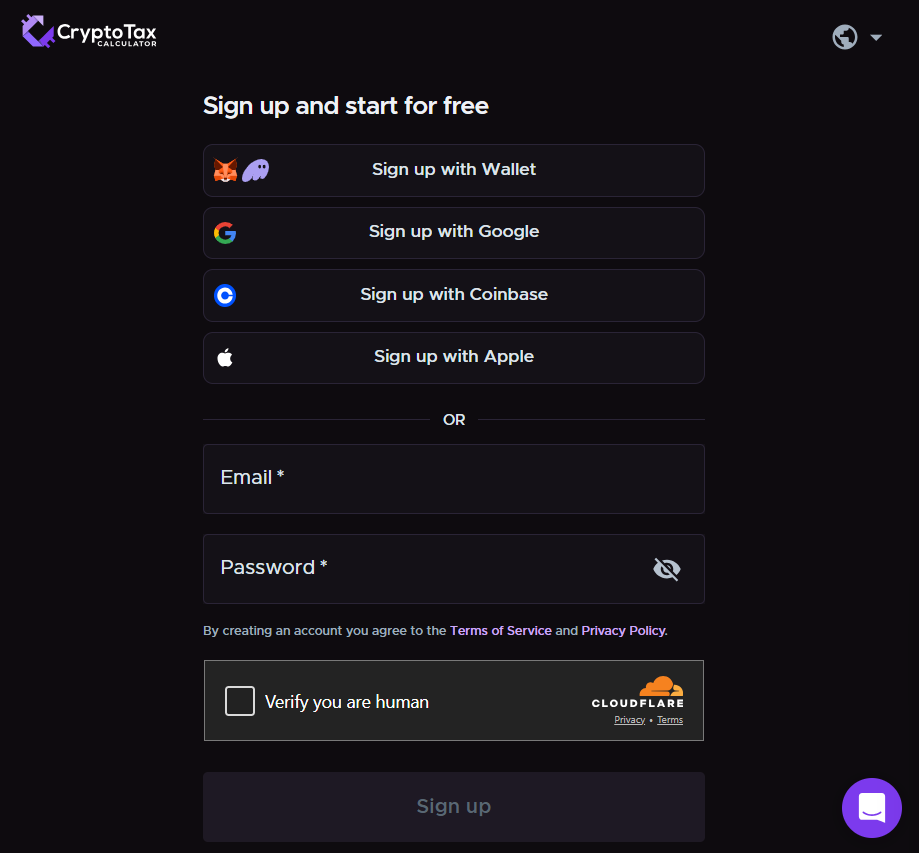

Step 1: Create an account on Crypto Tax Calculator, or log in if you already have one.

Note: If you are new to Crypto Tax Calculator, please check their Getting Started Guide for an overview of how the platform works.

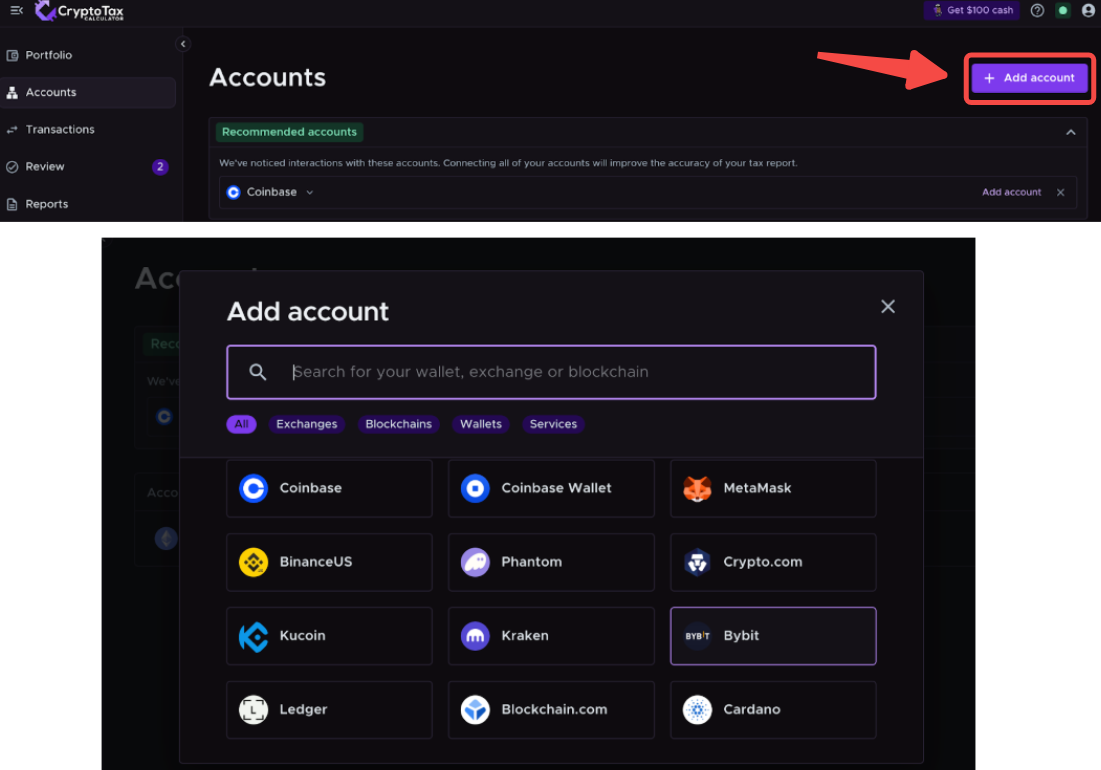

Step 2: Navigate to the Accounts tab, click on + Add accounts. Select Bybit from the list of exchanges.

Step 3: You can choose to import your Bybit transaction data into Crypto Tax Calculator by either API connection or CSV upload.

-

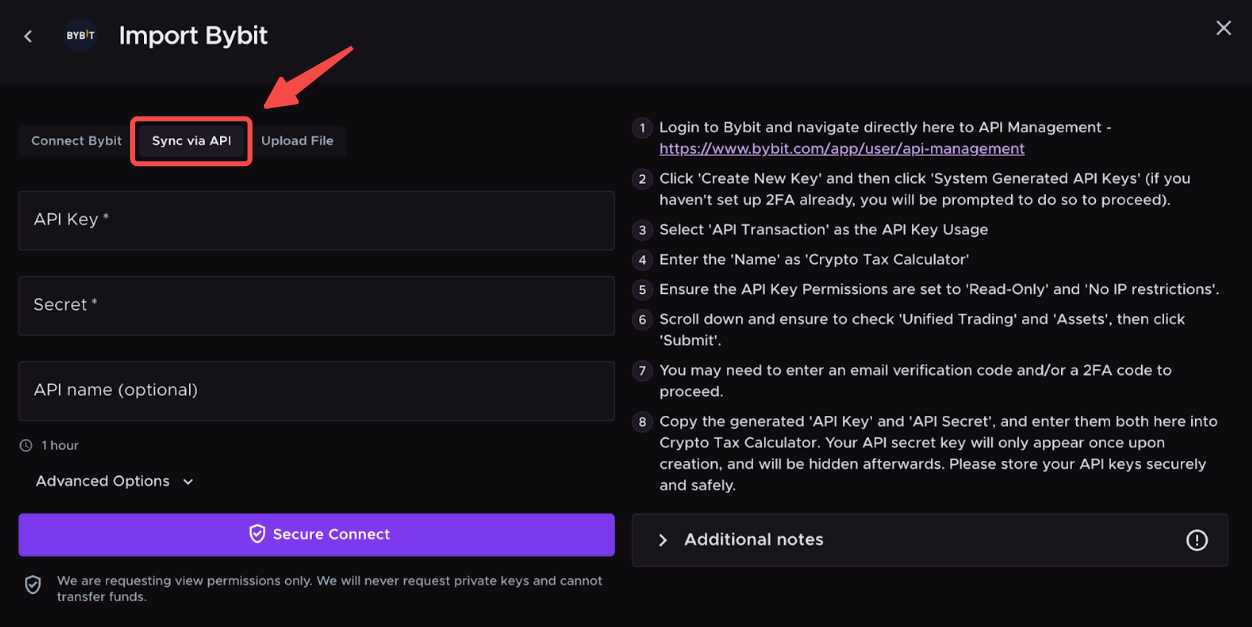

Via API Connection

Using an API connection is a seamless way to import your Bybit data into Crypto Tax Calculator. It ensures that your data will be updated over time, so any change in your Bybit balance is reflected in Crypto Tax Calculator.

For data import via API connection, please make sure to set up your API key with the following information on your Bybit account:

-

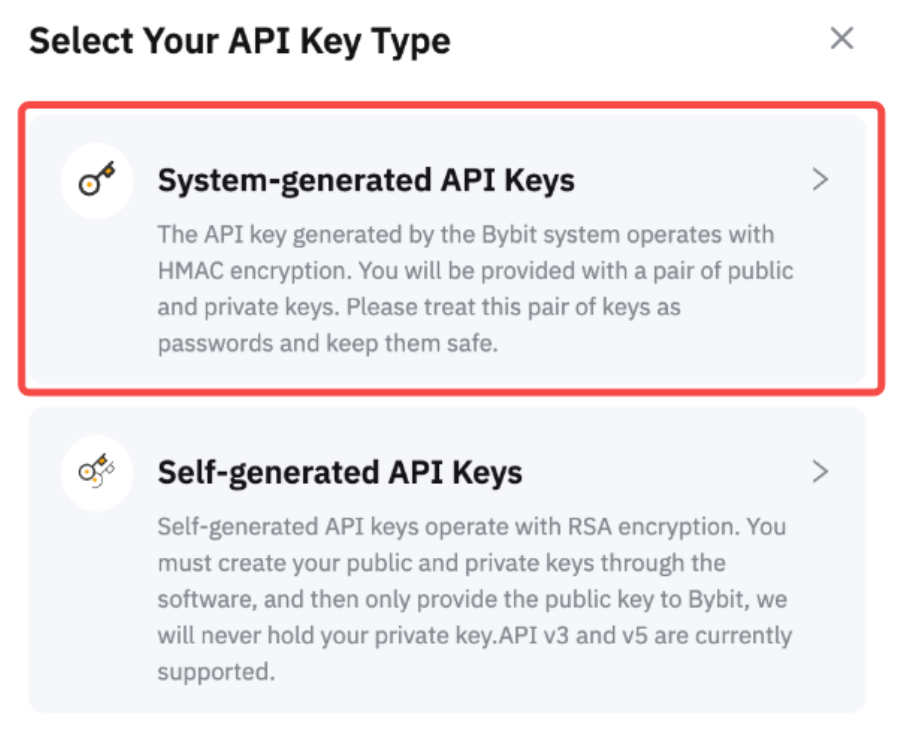

API Key Type: System Generated API Keys

-

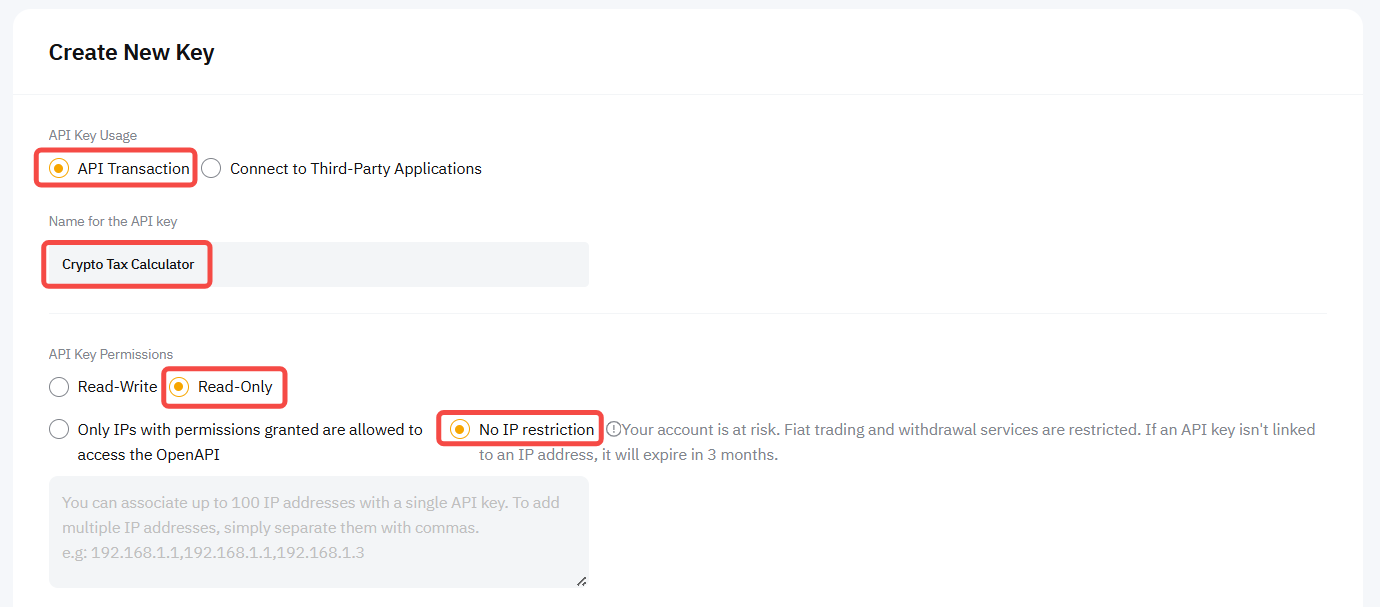

API Key Usage: API Transaction

-

Name for the API Key: Crypto Tax Calculator

-

API Key Permissions: Read-Only & No IP restrictions

-

Ensure that Unified Trading and Assets are selected to receive a complete report.

Once you have created the API Key on Bybit, select the option Sync via API in Crypto Tax Calculator and enter the generated API Key and API Secret. Click Secure Connect once done.

Notes:

— Your API secret key will only appear once upon creation, and will be hidden afterwards. Please store your API keys securely and safely.

— For a detailed guide on how to create an API key, please refer to this article.

— Once authorized, Crypto Tax Calculator will automatically import your Bybit transaction history. The process may take from a few seconds to a few minutes, depending on the number of transactions, and you’ll see a confirmation when all data is imported.

-

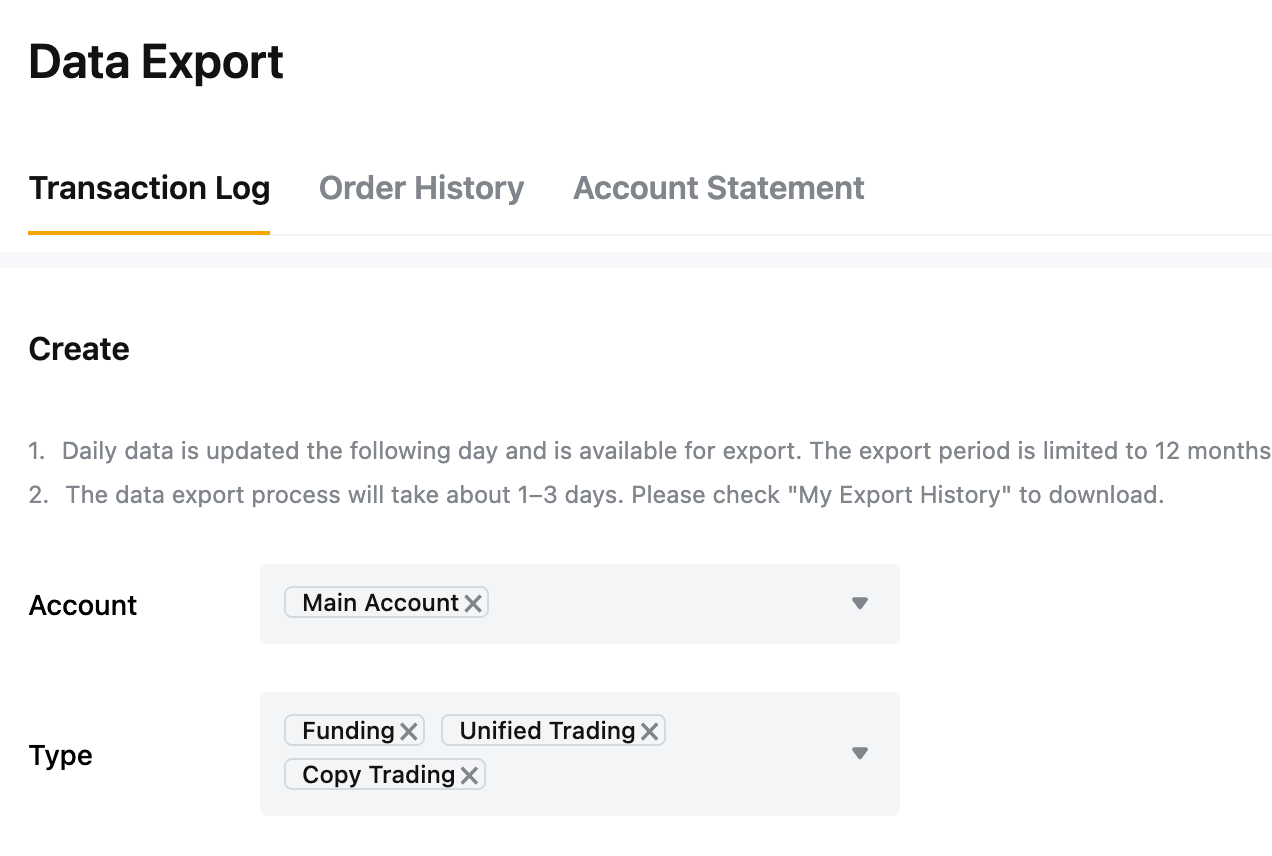

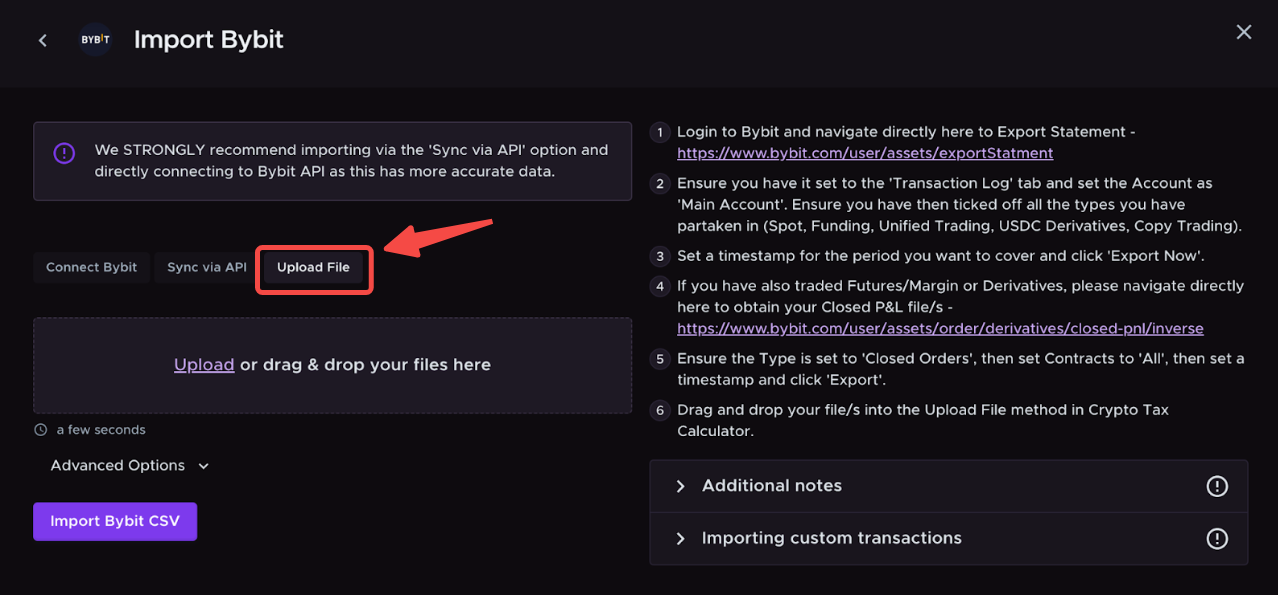

Via a CSV file

For a data import via CSV file, please go to your Data Export page on your Bybit account and ensure to retrieve the following information:

-

Select the tab Transaction Log.

-

Ensure you have set the Account as Main Account.

-

Select all types of trading you have participated in: Spot, Funding, Unified Trading, USDC Derivatives, Copy Trading, etc.

-

Ensure you have selected the correct timestamp for your tax report.

-

If you have also traded in Futures/Margin or Derivatives, please go to this page to obtain your Closed P&L file(s), by selecting Closed Orders and setting Contracts to All.

Once you have downloaded your Data Export File from Bybit, select the option Upload File in Crypto Tax Calculator and drag and drop your file(s) or click on the Upload button. Click Import Bybit CSV once done.

Notes:

— You may reach a timestamp period limit when trying to export your data. If so, please proceed to export multiple statements to cover the entire period. For example, if the maximum time range that can be selected is one year and you need 2 years of data, please proceed to export 2 statements, one for each year.

— For a detailed guide on how to export your data, please consult this page.

— Please make sure to verify the data imported and to double-check that the transaction details match your expectations from Bybit. Crypto Tax Calculator will alert you if any data seems missing or if there are errors in the file.

Step 4: Crypto Tax Calculator will calculate your gains, losses, and income and prepare a tax report that you can file with your taxes. It may flag missing data or errors that you will need to review and verify to ensure accuracy.